Coreco Market Update

In the aftermath of the Budget there have been a lot of questions around 95% mortgages. This, therefore, is everything we know so far.

95% LTV Mortgages

What we do know is that this will work very similar to the old Help to Buy Mortgage Guarantee Scheme introduced in 2013, which ended by 2017.

The Government will guarantee part of the loan between 80% and 95%, which the lender pays a fee for, thus giving the lender confidence to lend up to 95% Loan-to-Value. Therefore, lenders know that they will have cover on the riskier part of the lending if they did need to repossess the property and sell it quickly.

It is important to recognise that this guarantee is only for the lender and does not protect the borrower in any way.

As ever the devil is in the detail, but we understand that this will be available to all buyers on all properties up to £600,000, rather than just first-time buyers on New Build properties under the current Help to Buy Equity loan scheme.

All mortgages will need to be repayment, not interest-only, and all lenders will also be required to offer a five-year fixed rate product.

It must be a residential mortgage, not a second home, and not a buy-to-let.

Name-checked were HSBC, Santander, Lloyds, NatWest, and Barclays that will offer these 95% mortgages from next month, with more including Virgin Money after that, Chancellor Sunak said.

In all other aspects, it works as any other mortgage does and the borrower will have to meet the standard affordability rules to justify the level of borrowing required. It may well be that there are slightly stricter rules around maximum income multiples on these loans, for example, a maximum of 4.5 times income but this remains to be seen.

Interest Rates

As of yet, we do not know what rates will look like under the scheme, but with current 90% LTV rates around 3.25% – 3.5% you would assume they would be slightly higher, and probably starting with a 4 rather than a 3.

People forget that the Government Guarantee for lenders comes at a price, probably costing them around 0.9%, which has to be reflected in the price to the consumer.

There has been some press suggesting that rates will be much cheaper and affordability rules laxer, but this remains to be seen and seems doubtful at this stage.

Watch this space.

Why is the Government doing this?

The Government is introducing it to give lenders more confidence to offer more products at higher Loan-to-values, especially as they have made the concept of homeownership for all one of their central tenets.

Based on what happened last time it does look like a scheme of this type will work to provide more choice for borrowers, as things stand currently you can count the number of 95% LTV products available on one hand.

This could well make a significant difference to many struggling to save a larger deposit and will be especially good news for many first-time buyers who were not able to take advantage of the stamp duty holiday due to the lack of these types of products.

To listen to The Property Show Podcast Budget Special where we discuss all this please click below:

https://www.coreco.co.uk/podcasts/the-property-show-budget-2021-special

Best Mortgage Rates

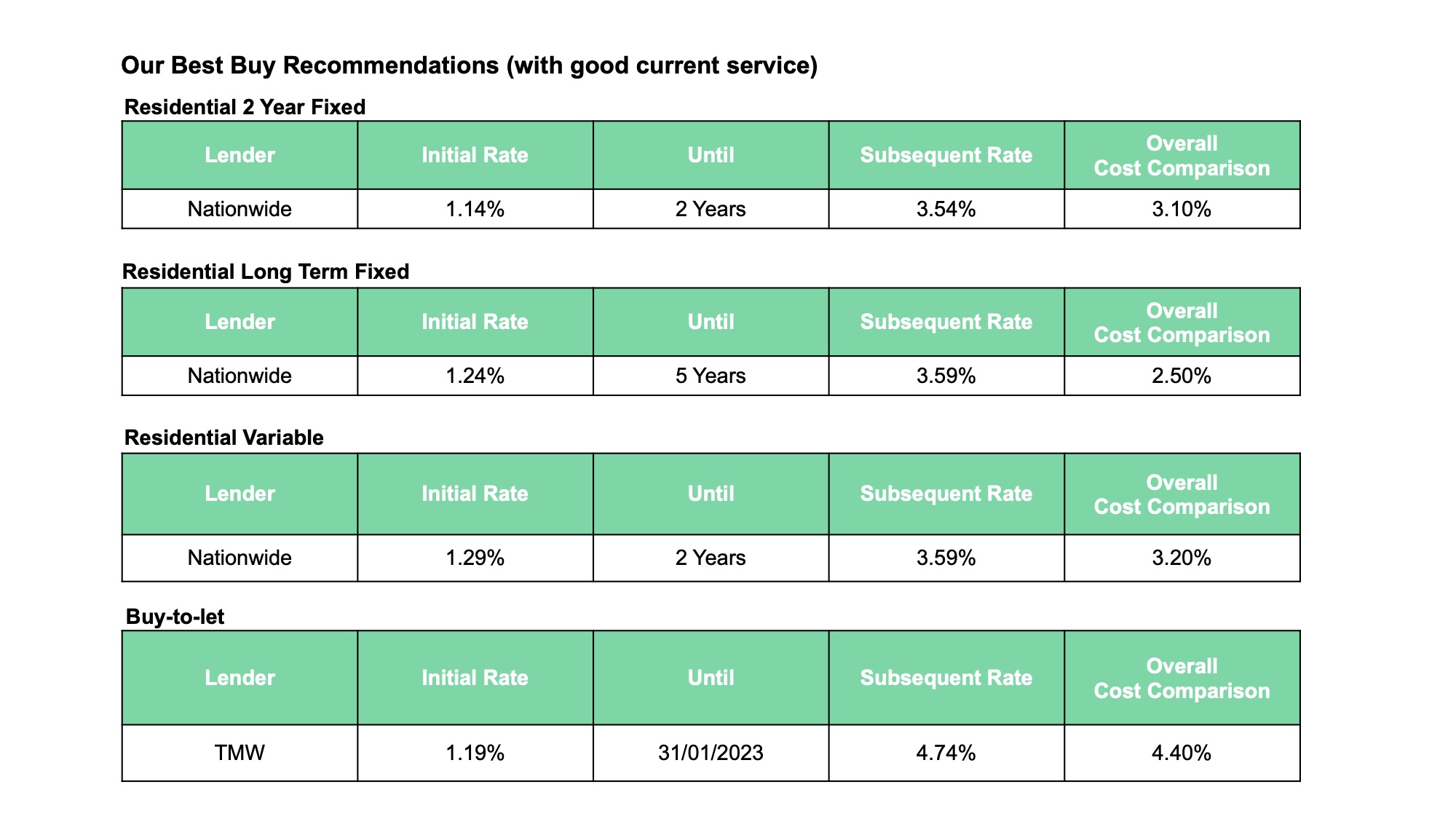

In terms of mortgage rates, for standard residential mortgages, borrowers can obtain 2-year fixes at 1.14%, (3.10% APRC) and 5-year fixes from 1.24%, (2.50% APRC) whilst variable tracker rates are around from 1.29%, (3.20% APRC).

Those looking at Buy-To-Let can now obtain products from 1.19%, (4.40% APRC) for a 2-year fixed or 5-year fixes are available from 1.64% (3.80% APRC)